Same day title loans offer quick cash using your vehicle's title as collateral, accessible despite credit history but with high-interest rates and repossession risk if not repaid on time. Repayment is structured for urgency but requires understanding terms and conditions.

“Struggling with short-term cash needs? Same-day title loans could be a quick solution. This article explores these innovative lending options, offering a comprehensive guide to understanding their appeal. From the basics of how they work to the benefits and considerations involved, we delve into why same-day title loans have become a popular choice for those seeking immediate financial relief. By the end, you’ll grasp the mechanics and implications of this unique cash solution.”

- Understanding Same Day Title Loans: A Quick Cash Solution

- How Do Same-Day Title Loans Work? The Process Unveiled

- Benefits and Considerations for Short-Term Lending

Understanding Same Day Title Loans: A Quick Cash Solution

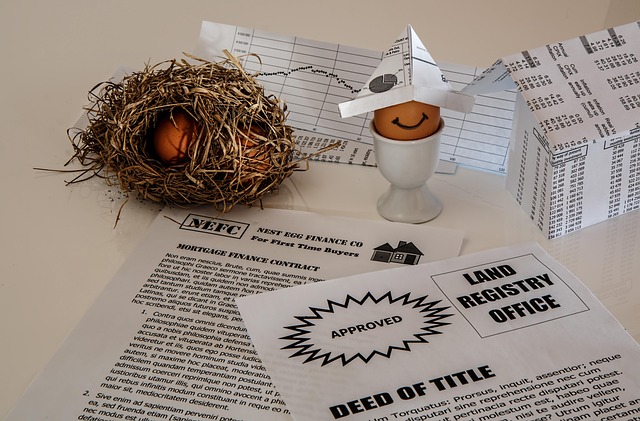

Same day title loans offer a quick and accessible solution for short-term cash needs. This type of loan utilizes your vehicle’s title as collateral, allowing lenders to provide funds on the same day an application is approved. The process is designed to be efficient, often with minimal documentation required, and can be completed entirely online or in-person. This makes same day title loans a viable option for those who need immediate financial support but may not have the best credit history.

Car title loans, a specific type of same day title loan, are short-term cash advances secured by your vehicle’s title. To determine loan eligibility, lenders assess the value of your vehicle and evaluate factors such as your income and creditworthiness. Despite not always relying on traditional credit checks, same day title loans still come with risks and potential drawbacks, including high-interest rates and the risk of repossession if you fail to repay the loan on time. Therefore, it’s crucial to thoroughly understand the terms and conditions before securing a loan using your vehicle’s title.

How Do Same-Day Title Loans Work? The Process Unveiled

Same-day title loans offer a swift solution for immediate financial needs. The process begins when a borrower provides their car’s title as collateral to a lender. This streamlined approach eliminates traditional loan application redundancies, allowing for a faster turnaround. The lender assesses the vehicle’s value and offers a loan based on that assessment, ensuring quick access to funds.

Once agreed upon, the borrower receives their fast cash within the same day. Repayment typically involves structured payments, often over a shorter period compared to conventional loans. This method is particularly appealing for those requiring urgent financial assistance, offering an efficient alternative to traditional banking options, especially when considering car title loans as collateral.

Benefits and Considerations for Short-Term Lending

Same day title loans can be a rapid solution for those facing short-term financial challenges. One of the primary benefits is their convenience; these loans allow borrowers to access cash within hours, providing immediate relief during unexpected events or urgent needs. This accessibility is particularly valuable in situations where traditional banking options are not readily available or suitable.

When considering short-term lending, transparency and awareness are key. Interest rates for same day title loans can vary significantly depending on the lender and the value of the collateral. Borrowers should carefully review the terms and conditions, including any fees and charges, to ensure they understand the financial commitment. Additionally, comparing different lenders, such as Dallas Title Loans, can help individuals find competitive rates and suitable repayment terms tailored to their needs.

Same day title loans can be a viable option for individuals facing short-term financial emergencies, offering quick access to cash secured by your vehicle. While this type of lending provides a convenient solution, it’s crucial to understand the benefits and potential drawbacks before borrowing. By thoroughly evaluating your situation and choosing a reputable lender, you can make an informed decision that best suits your needs. Remember, responsible borrowing is key to ensuring a positive experience with same day title loans.